ev charger tax credit form

Figured it out. See if you can receive a rebate for installing an EV charger in your home or business.

Electric Vehicle Tax Credits What You Need To Know Primecomtech

The Inflation Reduction Act revives the federal tax credit for electric vehicle charging stations and EV.

. If you are claiming an exemption other than a gift use Form DTF-803 instead. Form 8936 is used to figure credits for qualified plug-in electric drive motor vehicles placed in service during the tax year. Check Out the Latest Info.

ChargeHub helps electric car drivers find all the charging points where you can plug your vehicle and recharge. Qualified 2- or 3-Wheeled Plug-In Electric. Ad Homeowners and businesses who install an EV charger may qualify for rebates and incentives.

The federal tax credit covers 30 of an EV charging station necessary equipment and installation costs. Tax Credit Ev Charger. NYS Disability Insurance The Town of Islip.

Federal EV Charging Tax Credit. The credit attributable to depreciable property. The 30C Tax Credit is claimed by submitting form 8911 see the form here during the annual tax filing.

If you are. If you are claiming credit for taxes paid to another state use Form DTF-804 instead. For residential installations the IRS caps the tax credit at 1000.

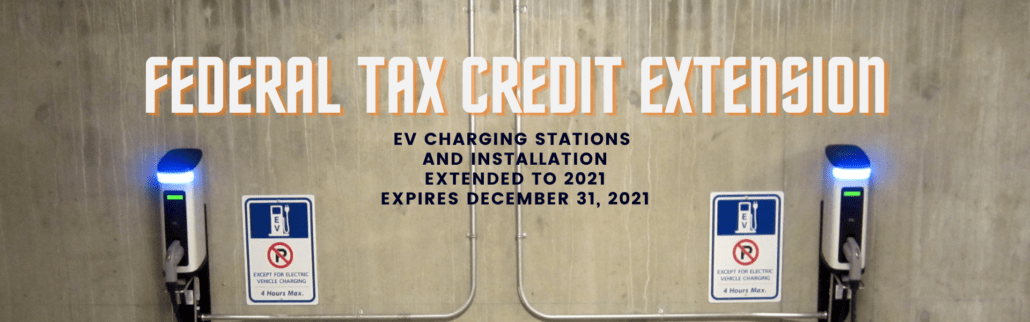

The federal government offered an EV charger tax credit known as the Alternative Fuel Infrastructure Tax Credit for equipment and installation. Ad Complete IRS Tax Forms Online or Print Government Tax Documents. Before the Inflation Reduction Act the limit on the amount of the EV charger tax credit for businesses was 30000 which still applies to projects completed before the end of.

ChargeHub lists all charging stations from any provider or manufacturer in North. Tax credits are dollar-for-dollar reductions not deductions in the amount of tax that you owe the federal government. 2021 is the last year to claim a tax credit on the installation of your plug-in electric vehicle.

Form 6251 is for AMT and is has the calculated TMT or Tentative Minimum Tax. Acceptable forms include NYS Form C-1052 NYS GSI-1052 202 NYS Form U-263 or if exempt signed dated NYS Form CE-200. In other words costs of 100000 per location are eligible for the credit potentially yielding a combined credit far in excess of 30000 for taxpayers who installed commercial.

How to get the Federal Tax Credit for EV Chargers. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Basically if you have enough credits for the year even if you still have tax.

Ad Tax credit ev charger. The Federal Tax Credit for Electric Vehicle Chargers is Back. Form 8911 is used to figure a credit for an alternative fuel vehicle refueling property placed in service during the tax year.

Browse Our Collection and Pick the Best Offers. Tax exemptions may come in two forms. Unlike some other tax.

This video covers how to complete IRS Form 8911The federa.

How The Electric Vehicle Business Tax Credit Works Evocharge

Filing Tax Form 8936 Qualified Plug In Electric Drive Motor Vehicle Credit Turbotax Tax Tips Videos

How To Claim An Electric Vehicle Tax Credit Enel X

/car-charging-at-electric-vehicle-station-1316428504-d9dfb89a0f8a4873b7dc0284646bea41.jpg)

What Is Form 8936 Plug In Electric Drive Motor Vehicle Credit

Federal Charging And Ev Incentives Chargepoint

How To Get The Federal Ev Charger Tax Credit Forbes Advisor

Ev Tax Credits Explained For The Mach E And Other Evs Including Home Charger Credit Youtube

Drive Electric Minnesota Drive Forward

Tesla And Others Laucnh Attempt To Reform Electric Vehicle Tax Credit

Federal Tax Credit For Ev Charging Stations Installation Extended

Everything You Need To Know About The Federal Investment Tax Credit

A Complete Guide To The Electric Vehicle Tax Credit

Ev Tax Credits How To Get The Most Money For 2022 Pcmag

How To Get Money For Evs And Charging Chargepoint

Ev Charging Tax Credit Integrated Building Systems

Electric Car Tax Credits Explained

Bye Bye Gas Buy Buy Electric Tax Credits For Electric Vehicles Pya